Connecticut Assisted Living Market Report: Opportunities in Closed Nursing Homes

In this market report, Kalei Stockstill, a senior living consultant, interviews Thomas Simjian, a real estate agent specializing in Connecticut and Rhode Island, to discuss opportunities for acquiring and repurposing closed assisted living facilities and nursing homes in Connecticut. Below is a cleaned-up and structured version of their conversation, highlighting key properties and insights for potential investors.

Introduction

Kalei Stockstill introduces the discussion, focusing on Connecticut’s market for assisted living facilities, which are often referred to locally as convalescent homes or nursing homes. Thomas Simjian, the Connecticut expert, highlights the prevalence of closed facilities, many of which shut down during the COVID-19 period, presenting unique opportunities for redevelopment.

Property Opportunities in Connecticut

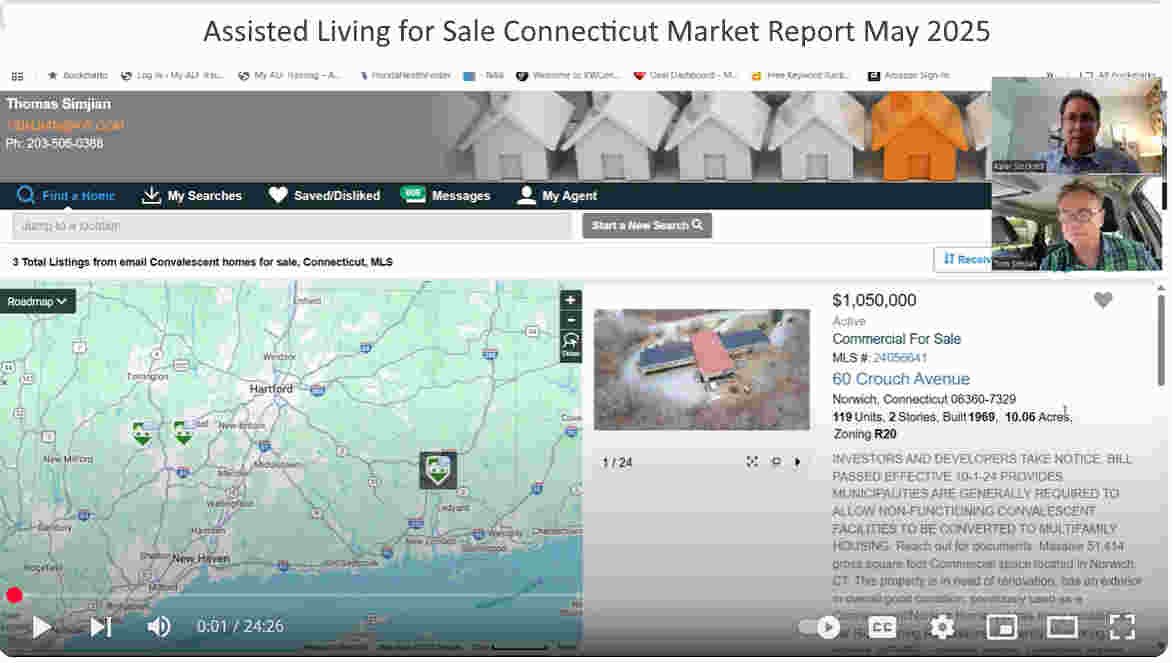

1. 60 Crouch Avenue, Norwich, CT

- Price: ~$1.05 million

- Size: 51,000 square feet, two stories

- Capacity: Licensed for 119 beds (some shared rooms, potentially ~60 private rooms)

- Land: 10 acres, private setting

- Condition: Poor, with some water damage from frozen pipes, but structurally sound

- Features:

- Public utilities (gas, water, electric)

- Large diesel backup generator

- Cafeteria and social rooms

- Opportunity:

- Ideal for revitalization using an SBA 504 loan with ~15% down

- Potential for phased renovation (two wings, allowing one to be completed and occupied while the other is renovated)

- Estimated renovation cost: ~$2 million, bringing total project cost to ~$3 million

- Competitive pricing for 100+ beds, with low per-bed costs compared to markets like Florida

- Location: Near casino areas, adjacent to an elementary school, surrounded by wooded areas and neighborhoods

- Market Considerations: Research needed on local Medicaid programs and competition, but low acquisition and renovation costs suggest strong cash flow potential.

2. Watertown, CT (Outside Waterbury)

- Price: ~$1.5 million (negotiable)

- Size: 12,000 square feet

- Capacity: Formerly 46 beds, likely better suited for 20–25 beds

- Condition: Some water damage from frozen pipes, but in better shape than Norwich property

- Features:

- Country setting, surrounded by expensive homes

- Eight bedrooms, eight bathrooms (four with shower/jacuzzi)

- Opportunity:

- Smaller project, ideal for a sub-25-bed facility

- Total project cost (acquisition + renovation) estimated at ~$2.2 million

- Potential for strong cash flow if targeting private-pay residents in a high-income area

- Challenges: Previous attempts to convert to studio apartments faced town pushback; town prefers continued healthcare use.

3. Wolcott, CT (Near Waterbury, Litchfield County)

- Price: $4.5 million

- Size: 50,000 square feet, single story

- Capacity: 73 patient rooms, with adjacent 6.5-acre parcel approved for a 140-unit assisted living facility

- Features:

- Secondary access via Evans Terrace for phased expansion

- Residential area with many homes

- Opportunity:

- Largest and priciest project, suitable for veterans’ housing or independent living

- Potential to develop the adjacent parcel for additional units, though market demand for 213 total beds requires research

- Considerations: Higher cost and scale make this a more complex project, best for experienced operators with strong financing.

4. Ansonia, CT (Outside New Haven)

- Price: $3.25 million (potentially negotiable to ~$3 million)

- Size: 47,000 square feet, three floors

- Capacity: Formerly 52 units (beds), likely 50+ beds post-renovation

- Condition: Needs work (some boarded-up windows, deferred maintenance), but more modern than Norwich property

- Features:

- Public utilities (water, sewer, natural gas)

- Outdoor garden, ample parking (though low parking ratios needed for senior living)

- Covered drive-up canopy

- Opportunity:

- Acquisition at ~$70/square foot, significantly below replacement cost

- SBA financing viable, with potential for seller financing on down payment

- Densely populated area with smaller homes, suggesting demand for affordable senior care

- Challenges: Exterior and interior personalization needed to transition from nursing home to assisted living aesthetic.

5. Hartford, CT (Capital City)

- Price: $1.9 million

- Size: 50,000 square feet

- Capacity: Formerly 45 units, potentially 60–70 beds with private rooms

- Condition: Gutted shell, requiring significant renovation

- Features:

- Public utilities (water, sewer, natural gas)

- Two courtyards, ideal for memory care or resident amenities

- Generator, sprinklers, and AC units included

- High parking ratio (>1 space/1,000 sq ft)

- Opportunity:

- Low acquisition cost (~$40/square foot), with renovation estimated at $1–1.5 million

- Total project cost of ~$3–3.5 million for 60–70 beds

- Courtyard layout enhances resident experience, with potential for memory care specialization

- Recent (expired) permit for conversion to 48 apartments suggests flexibility for alternative uses

- Location: Central Hartford, a strong market for urban senior living.

6. Unpriced Property (Avoid)

- Details: 42-room nursing home, owner relocating business to a new facility

- Challenges:

- Sale-leaseback structure with owner vacating and competing nearby

- Not recommended for assisted living due to competitive risk

- Potential for alternative uses (e.g., office, surgical center), but requires full redevelopment

7. Waterbury, CT (High-Priced, Likely Operating)

- Price: $6.5 million

- Size: 8,000 square feet

- Details: Limited information, likely an operating facility

- Considerations: High cost and small size make it less attractive compared to other opportunities.

Key Insights for Investors

- Market Trends: Many Connecticut nursing homes closed during COVID-19, creating a supply of large, underutilized properties at low acquisition costs.

- Financing: SBA 504 loans are ideal, requiring ~15% down and covering both acquisition and renovation. Sellers may hold part of the down payment for properties on the market for a while.

- Renovation Strategy: Phased renovations (e.g., completing one wing at a time) can minimize upfront costs and generate revenue early. Most properties require $1–2 million in renovations due to water damage or deferred maintenance.

- Market Positioning: Research local Medicaid, state programs, and private-pay demand to determine pricing and occupancy potential. High-income areas (e.g., Watertown) may support premium rates, while urban areas (e.g., Hartford) offer density-driven demand.

- Town Regulations: Some towns resist conversion to residential housing, preferring healthcare uses, which aligns with assisted living redevelopment.

- Competitive Advantage: Connecticut’s opportunities are more cost-effective than markets like Florida, with per-square-foot costs as low as $40–70, compared to $500,000 for a 14-bed facility in Florida.

Contact Information

Thomas Simjian is the go-to expert for Connecticut and Rhode Island senior living opportunities. To explore these properties, including off-market deals, contact Thomas via the consultancy’s website under “Our Team” or request inclusion in his drip campaign for new listings.

Conclusion

Connecticut’s closed nursing homes present compelling opportunities for experienced assisted living operators. With low acquisition costs, favorable SBA financing, and the potential for phased renovations, these properties offer strong cash flow potential in both urban and suburban markets. Reach out to Thomas Simjian to discuss how to structure a deal and bring these facilities back to life.